PayPal and the American Rescue Plan Act of 2021

UDPATE: This change has been delayed until 2024.

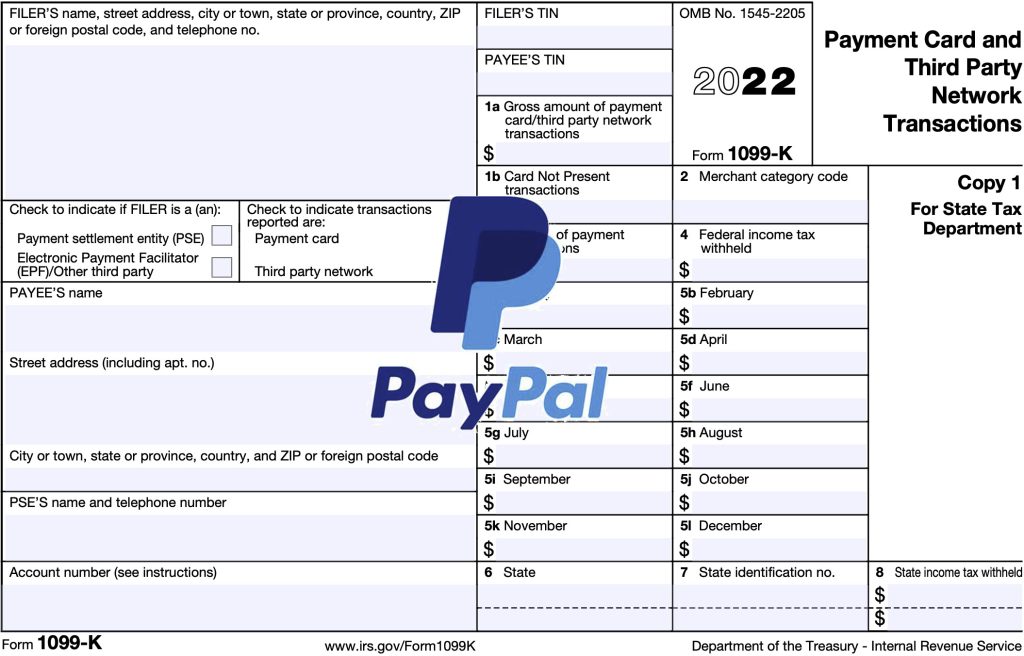

PayPal already report payments to the IRS but only for business accounts that have revenues greater than $20,000 involving more than 200 transactions. Starting 2022, this criteria changes and any account with more than $600 in revenue will now be getting a 1099-K statement. This revenue does not include payments such as gifts and payments to friends such as paying your share of a restaurant bill.

What does this mean? Well it should mean nothing really other than you now have a 1099-K statement whereas before you did not.

Can it cause issues? Some small business operations, e.g. freelancers not operating under the umbrella of an actual company, could already be getting a 1099-NEC from their clients when they meet the $600 threshold. If the same payments are also made via PayPal then it creates a duplicate. As such, tax payers might find themselves having to explain to the IRS that the transactions are covered by both. In this case, you need good records so you can match the payments to each other.

You may find PayPal reaching out to request that you identify tax status and/or your transactions as business or personal. To keep things simple, it is best not to use your PayPal account for both business and private transactions. Have two accounts: one for business set up as a PayPal Business account and one private for your personal transactions. It does not mean your personal account might not trigger a 1099-K but at least it keeps your records separate making traceability easier.

NOTE: This change also applies to other payment methods such as Venmo and Square and impacts operations such as Uber, Etsy etc.

See more here.